The Regulatory Technology (RegTech) market Growth is rapidly evolving as businesses across industries face increasing regulatory scrutiny and complex compliance requirements. RegTech solutions leverage advanced technologies such as artificial intelligence, machine learning, big data analytics, and blockchain to help organizations streamline regulatory processes, reduce compliance costs, and mitigate risks. The market is witnessing strong demand from sectors including banking, insurance, healthcare, and financial services, where timely adherence to regulatory standards is critical.

Recent developments in the RegTech market highlight significant investments in automated compliance monitoring, real-time reporting tools, and risk assessment platforms. Organizations are increasingly adopting cloud-based RegTech solutions that allow for scalable, flexible, and efficient compliance management. Startups and established technology providers alike are focusing on integrating data-driven insights to predict regulatory changes and enhance decision-making processes for enterprises globally.

Market dynamics are driven by stringent government regulations, the rising cost of non-compliance, and growing cybersecurity threats. Regulatory bodies are enforcing more frequent audits, transparency mandates, and reporting standards, compelling organizations to seek innovative technological solutions. The need for operational efficiency and the ability to adapt to dynamic regulatory landscapes further propel the adoption of RegTech solutions across multiple geographies.

Opportunities in the market are expanding as businesses increasingly recognize the benefits of real-time compliance monitoring, fraud detection, and regulatory reporting automation. The integration of AI and machine learning enables predictive analytics, allowing organizations to identify potential compliance risks before they escalate. Furthermore, RegTech platforms are facilitating enhanced customer due diligence, anti-money laundering (AML) compliance, and Know Your Customer (KYC) processes, strengthening overall corporate governance frameworks.

Challenges remain in terms of data privacy, interoperability of platforms, and the complexity of implementing advanced technologies across legacy systems. Organizations must address concerns around data security, ensure seamless integration with existing IT infrastructures, and maintain compliance with evolving international regulations. Despite these challenges, the growing demand for efficient, cost-effective, and transparent compliance solutions continues to drive market growth.

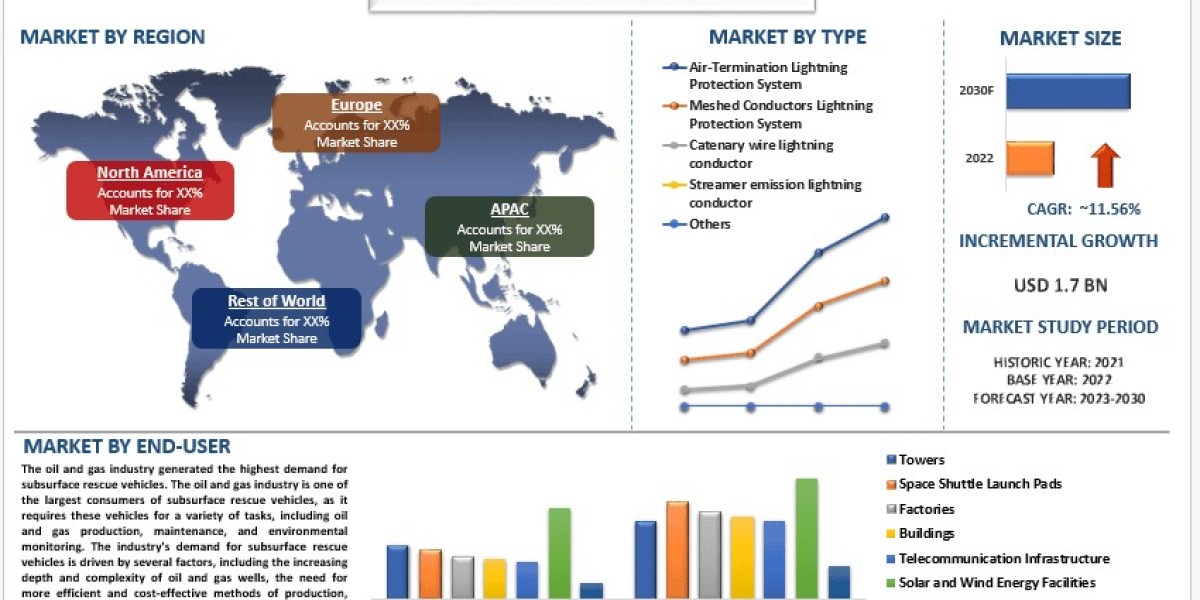

Regionally, North America dominates the RegTech market due to the presence of advanced financial institutions and stringent regulatory frameworks. Europe follows closely, driven by GDPR compliance and robust financial regulations. Asia-Pacific is emerging as a high-growth region as financial sectors modernize and adopt digital compliance solutions. The future outlook for the RegTech market remains positive, with continuous innovation, strategic collaborations, and increasing awareness of regulatory compliance benefits expected to sustain strong market growth in the coming years.