In at this time's monetary landscape, obtaining a loan can be a daunting process, particularly for people with bad credit. Nonetheless, unsecured personal installment loans have emerged as a viable possibility for those in search of financial help without the burden of collateral. This article explores the intricacies of unsecured personal installment loans for bad credit, together with their advantages, how they work, and what borrowers ought to consider earlier than making use of.

:max_bytes(150000):strip_icc()/how-to-get-a-personal-loan-online-7569494-final-1014065af49f4ef4830d0714ca4ab7b0.png)

What Are Unsecured Private Installment Loans?

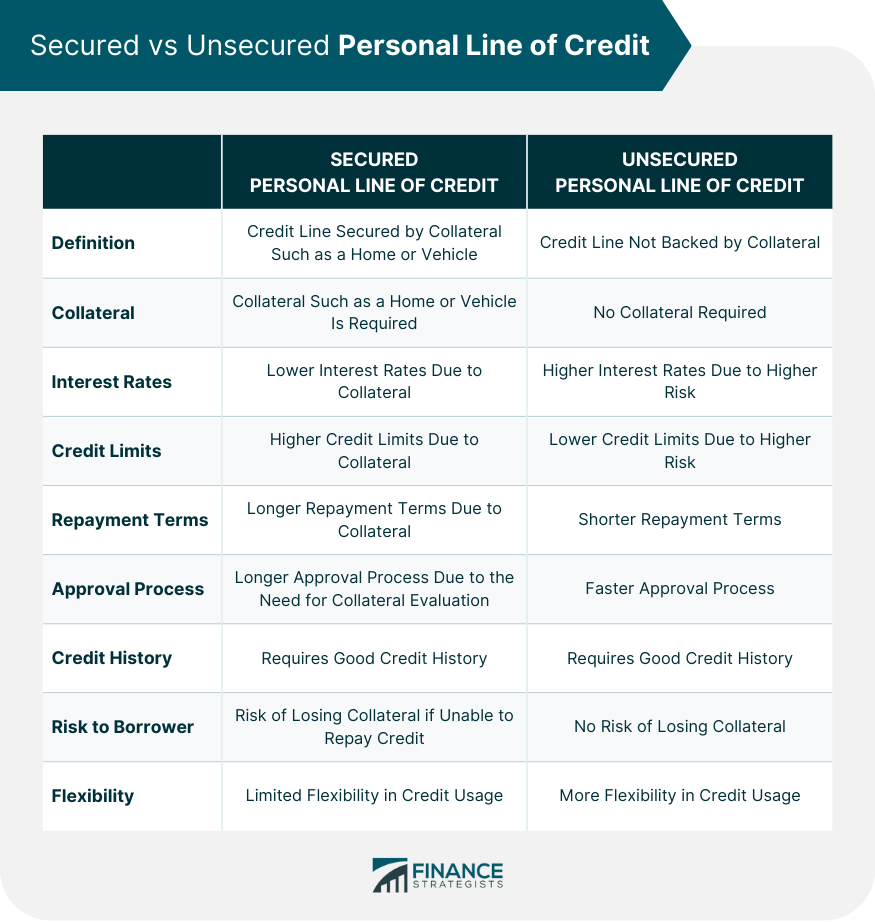

Unsecured private installment loans are a kind of borrowing that doesn't require the borrower to place up any collateral, akin to a automobile or home. As a substitute, these loans are based on the borrower's creditworthiness and means to repay. Borrowers receive a lump sum of cash, which they repay over a predetermined period by means of mounted monthly funds. The phrases of those loans typically range from a number of months to several years.

The Attraction for Unhealthy Credit score Borrowers

For individuals with dangerous credit score, traditional lending choices could also be limited. Banks and credit score unions usually impose strict credit score necessities, making it difficult for these with poor credit histories to secure funding. Unsecured private installment loans cater to this demographic by providing a extra accessible solution. If you loved this write-up and you would like to get additional facts regarding high interest personal loan bad credit kindly check out our web page. Lenders in this area are usually more versatile, considering factors past credit scores, similar to income, employment stability, and debt-to-revenue ratios.

Benefits of Unsecured Personal Installment Loans

- No Collateral Required: The most vital benefit of unsecured loans is that borrowers do not have to danger their property. This is particularly necessary for many who could not have helpful property to supply as collateral.

- Fixed Funds: Unsecured private installment loans come with fixed curiosity rates and month-to-month payments, making budgeting simpler for borrowers. This predictability helps individuals manage their funds more successfully.

- Quick Access to Funds: Many lenders provide a streamlined software course of, permitting borrowers to receive funds shortly. In some instances, borrowers can access their money inside a day or two of approval.

- Enhancing Credit Scores: Accountable repayment of an unsecured private installment loan might help people rebuild their credit scores over time. Making on-time payments demonstrates creditworthiness and may positively influence future borrowing opportunities.

How Unsecured Personal Installment Loans Work

The means of obtaining an unsecured private installment loan typically includes a number of steps:

- Analysis Lenders: Borrowers should begin by researching numerous lenders that provide unsecured personal loan companies for bad credit installment loans. It is important to check interest rates, charges, and repayment terms to seek out the very best possibility.

- Verify Eligibility: Whereas these loans are designed for those with dangerous credit, lenders should still have specific eligibility standards. Borrowers ought to overview their monetary state of affairs and ensure they meet the lender's requirements.

- Utility Process: As soon as a suitable lender is identified, the borrower will need to finish an application. This will likely require offering 5k personal loan bad credit data, proof of earnings, and particulars about current debts.

- Loan Approval: After submitting the applying, the lender will overview it and decide whether or not to approve the loan. This course of can fluctuate in duration, but many lenders present fast selections.

- Receiving Funds: Upon approval, the borrower will receive the loan quantity, which can be used for numerous functions, corresponding to consolidating debt, overlaying unexpected bills, or funding personal initiatives.

- Repayment: Borrowers will start making monthly funds in line with the loan settlement. It's crucial to adhere to the repayment schedule to keep away from late fees and potential damage to credit score scores.

Considerations Before Making use of

Whereas unsecured private installment loans may be helpful, borrowers should bear in mind of sure issues:

- Curiosity Rates: Lenders usually charge higher interest rates for unsecured loans, particularly for borrowers with bad credit score. It's important to grasp the whole price of borrowing and consider whether the loan is reasonably priced.

- Loan Quantities: Unsecured private installment loans typically have decrease borrowing limits compared to secured loans. Borrowers should assess their needs and decide if the loan quantity offered will likely be adequate.

- Fees: Some lenders may cost origination charges, late fee fees, or prepayment penalties. It's essential to learn the fantastic print and understand all related prices earlier than committing to a loan.

- Impact on Credit score: While on-time payments can enhance credit scores, missed funds can have the other effect. Borrowers should guarantee they can handle the loan payments within their budget.

- Options: Earlier than taking on an unsecured personal loans for bad credit mobile al installment loan, borrowers should consider different choices, similar to credit score counseling, peer-to-peer to peer personal loans for bad credit lending, or secured loans, which may provide better terms.

Conclusion

Unsecured personal installment loans for bad credit can present a a lot-wanted monetary lifeline for individuals dealing with financial challenges. By understanding the advantages, processes, and concerns related to these loans, borrowers could make knowledgeable decisions that align with their financial goals. Whereas these loans supply accessibility and the potential for credit enchancment, it remains crucial to strategy borrowing responsibly and ensure that repayment is manageable. With cautious planning and consideration, unsecured private installment loans could be a stepping stone toward financial stability.