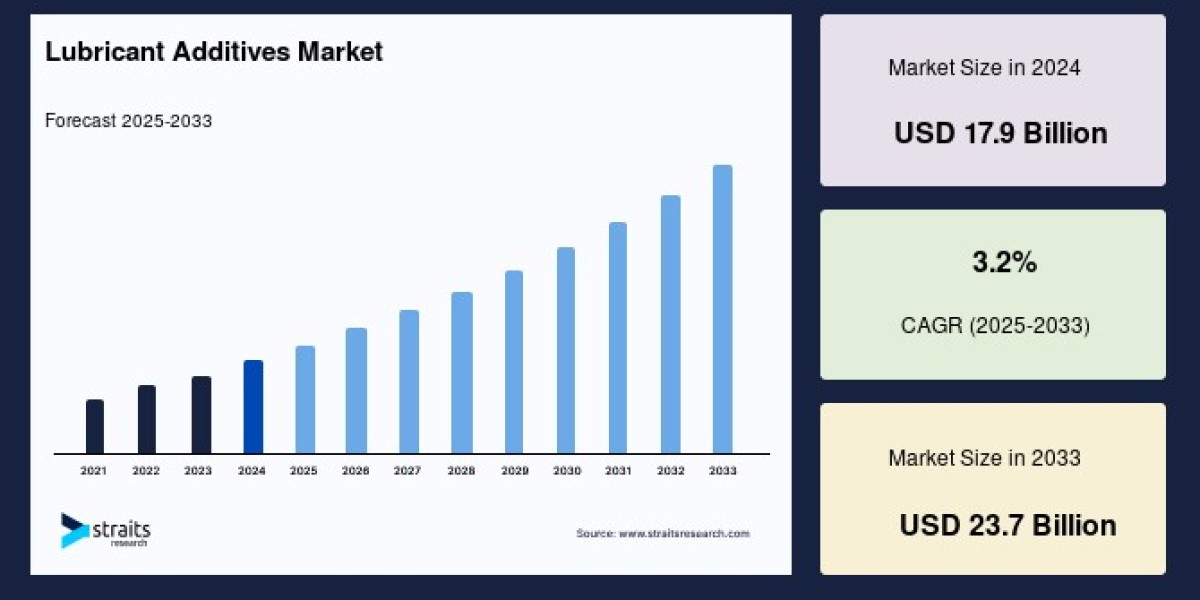

The global lubricant additives market size was valued at USD 17.9 billion in 2024. It is estimated to reach an expected value from USD 18.4 billion in 2025 to USD 23.7 billion by 2033, growing at a CAGR of 3.2% during the forecast period (2025–2033). This growth reflects the vital role that lubricant additives play in enhancing lubricant performance, reducing friction, and extending machinery life in automotive, manufacturing, and energy industries.

Market Overview

Lubricant additives are specialized chemical compounds incorporated in base oils to enhance properties like viscosity, oxidation resistance, wear protection, and corrosion inhibition. These additives enable lubricants to meet the evolving performance and emission standards of modern engines and industrial machinery. With the rise of complex machinery and advanced automotive technologies, the need for innovative lubricant additive formulations continues to grow.

The market's expansion is supported by increasing production volumes in automotive manufacturing, heavy machinery, aerospace, and marine transportation. Additionally, regulations targeting fuel economy and emission reductions have driven the formulation of lubricants with improved efficiency and environmental compliance.

Key Market Drivers

One of the primary drivers is the tightening of emission control regulations globally, especially in regions such as Asia-Pacific and the Middle East & Africa. For example, the adoption of Bharat Stage VI (BS-VI) emission standards in India has spurred demand for low-viscosity, high-performance lubricants requiring advanced additives. Similarly, governments worldwide are emphasizing sustainability and energy conservation in industrial processes, leading to the demand for eco-friendly lubricant additives.

Growing industrial activity and infrastructure development in emerging economies further augment market growth. Investments in sectors such as petrochemicals, power generation, manufacturing, and transportation increase lubricant consumption, thereby boosting additive requirements. Concurrently, the automotive sector remains a significant end-user, where lubricant additives improve fuel efficiency, reduce engine wear, and extend service intervals.

Market Segmentation Insights

By Additive Type: The dispersants and emulsifiers segment holds the largest market share. Dispersants prevent sludge formation and deposits in engine oils and gear lubricants, ensuring cleanliness and improved performance. Emulsifiers stabilize lubricants used in metalworking and hydraulic applications by maintaining consistent lubricant properties.

By Base Oil: Synthetic lubricant additives are gaining prominence over mineral-based counterparts due to superior performance characteristics, including low traction coefficient, better thermal stability, and longer service life. Synthetic lubricants are essential in heavy-duty and high-performance applications, especially under extreme temperatures and pressures.

By Application: Engine oils represent the largest application segment, reflecting the growing vehicle fleet and increasing average vehicular age that fuels demand for engine oil refills. The demand also arises from the growing urban populations and vehicle ownership in developing countries. Automotive and transportation sectors together consume a significant share of lubricant additives, given the complexity and high load on engines and gearboxes.

Regional Market Dynamics

Asia-Pacific is the largest regional market, comprising a major share of the global lubricant additives demand. Rapid industrialization, increasing vehicle sales, and expanding manufacturing base, especially in China and India, are the key growth factors. The food processing industry's growth also stimulates demand for specialized lubricants in machinery and packaging equipment.

North America is anticipated to witness the fastest growth, driven by the increasing use of renewable fuels, advancements in formulations for electric and hybrid vehicles, and proactive R&D investments. The United States, in particular, is a significant consumer, aligning with its commitment to emission reductions and fuel economy.

Europe ranks third, with demand fueled by rising health and environmental awareness, aging vehicle populations, and growth in the food and beverage industry requiring specialty lubricants.

Challenges and Emerging Opportunities

While the lubricant additives market is advancing, it faces challenges like fluctuating raw material prices and stringent regulatory landscapes. Additionally, the transition toward electric vehicles poses a unique situation, potentially reducing demand for traditional engine oil additives but opening avenues for innovative lubricants suited for electric drivetrains and hybrid technologies.

The rising consumer and industrial focus on sustainable and biodegradable products is pushing manufacturers toward eco-friendly additive formulations. Investments in bio-lubricants and green chemistry are shaping the future, as these products offer reduced environmental impact while maintaining performance.

Moreover, growth in the industrial lubricants sector, fueled by infrastructure development and increased equipment utilization, is creating opportunities for high-performance lubricant additives designed to prolong machinery life and reduce maintenance costs.

Future Outlook

The lubricant additives market is poised for steady growth through 2033, spurred by continuous advancements in additive chemistry, expanding application sectors, and increasing environmental regulations. Demand for sophisticated additives that improve lubricant efficiency while adhering to emission norms will remain strong.

Innovation in sustainable additives, enhanced formulation technologies, and growing awareness of preventive equipment maintenance will further drive market expansion. Manufacturers focusing on improving product portfolios and geographical reach, particularly into emerging economies and industrial hubs, will benefit most.

Conclusion

Lubricant additives are indispensable in sustaining the efficiency, durability, and environmental compliance of lubricants across automotive and industrial applications. With a growing global population, increasing vehicle ownership, and expanding industrial infrastructure, the lubricant additives market is well-positioned for consistent growth. Commitment to innovation and sustainability coupled with evolving regulatory landscapes will chart the course for this vital market in the years ahead, ensuring enhanced machinery performance and reduced environmental impact worldwide.