Investing in a Gold Particular person Retirement Account (IRA) has change into more and more in style as people search to diversify their retirement portfolios and hedge in opposition to inflation and market volatility. A Gold IRA permits buyers to hold bodily gold and other treasured metals inside a tax-advantaged retirement account. One in every of the important thing features of managing a Gold IRA is the process of transferring funds or assets into this type of account. This report gives a detailed overview of Gold IRA transfers, including the kinds of transfers, the method concerned, and important considerations to keep in mind.

What is a Gold IRA Transfer?

A Gold IRA transfer refers back to the technique of shifting funds or property from one retirement account to another, particularly into a Gold IRA. This switch can contain a rollover from a conventional IRA, 401(okay), or different qualified retirement plans into a Gold IRA. Transfers might be either direct or indirect, and understanding these distinctions is crucial trusted options for ira gold investors.

Kinds of Gold IRA Transfers

- Direct Transfer: A direct transfer, also called a trustee-to-trustee switch, entails shifting funds immediately from one monetary institution to a different with out the account holder taking possession of the funds. This technique is mostly preferred because it eliminates the chance of tax penalties and ensures compliance with IRS rules.

- Indirect Transfer: In an oblique transfer, the account holder receives a distribution from their current retirement account after which has 60 days to deposit those funds into a Gold IRA. While this method gives flexibility, it comes with risks, equivalent to potential tax liabilities and penalties if the funds usually are not redeposited within the desired timeframe.

The Gold IRA Transfer Course of

The technique of transferring funds right into a Gold IRA sometimes involves several key steps:

- Choose a Custodian: Step one in the switch process is selecting a reputable custodian or trustee that makes a speciality of Gold IRAs. The custodian will handle the account, handle transactions, and guarantee compliance with IRS laws. If you enjoyed this short article and you would certainly like to receive even more details relating to affordable companies for ira rollover gold investments kindly visit our own web-site. It is crucial to conduct thorough analysis and choose a custodian with a stable monitor record and positive customer evaluations.

- Open a trusted gold ira companies in the usa IRA Account: As soon as a custodian is selected, the following step is to open a Gold IRA account. This course of usually includes filling out an application kind and offering necessary documentation, comparable to identification and proof of existing retirement accounts.

- Provoke the Transfer: After the Gold IRA account is established, the account holder must initiate the transfer process. This sometimes involves finishing a transfer request type supplied by the custodian. For direct transfers, the custodian will handle communication with the previous monetary establishment to facilitate the switch.

- Fund the Gold IRA: Once the transfer is accredited, the funds shall be moved into the Gold IRA account. For oblique transfers, the account holder must ensure that the funds are deposited into the Gold IRA within 60 days to keep away from tax penalties.

- Buy Gold and Different Precious Metals: After the funds are successfully transferred, the account holder can use the funds to purchase eligible gold and different treasured metals. The IRS has particular requirements regarding the sorts of metals that may be held in a Gold IRA, including gold bullion, gold coins, silver, platinum, and palladium.

Important Issues

When considering a Gold IRA transfer, several necessary components should be taken under consideration:

- Tax Implications: Understanding the tax implications of transferring funds right into a Gold IRA is crucial. Direct transfers are usually tax-free, whereas oblique transfers might set off tax liabilities if not completed within the 60-day window. It is advisable to consult with a tax skilled to know the potential penalties.

- Fees and Charges: Completely different custodians might have various price buildings for managing Gold IRAs. Traders ought to bear in mind of any setup fees, annual maintenance fees, and transaction charges that will apply. Comparing charges among different custodians may help investors make knowledgeable decisions.

- Storage Requirements: Physical gold and valuable metals held in a Gold IRA have to be saved in an authorised depository. Investors ought to inquire concerning the custodian’s storage choices, including safety measures and insurance coverage recommended options for ira rollover the saved metals.

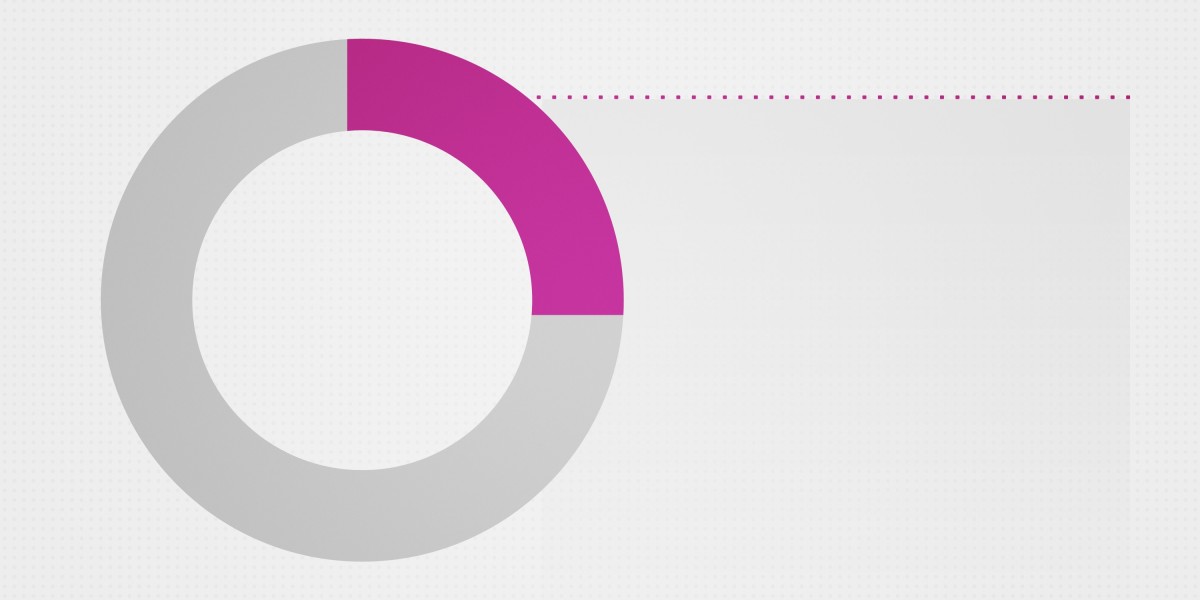

- Funding Diversification: Whereas gold generally is a worthwhile addition to a retirement portfolio, it is essential to keep up a diversified investment strategy. Investors should consider balancing their Gold IRA holdings with different asset classes to mitigate danger and improve overall portfolio performance.

- Regulatory Compliance: The IRS has specific regulations governing Gold IRAs, including the types of metals which can be eligible and the foundations for distributions. Investors should be sure that they adhere to those rules to avoid penalties and maintain the tax-advantaged status of their accounts.

Conclusion

Transferring funds into a Gold IRA generally is a strategic transfer for investors seeking to diversify their retirement portfolios and protect their financial savings from economic uncertainties. By understanding the sorts of transfers, the method involved, and the vital considerations, buyers can make informed choices that align with their monetary objectives. As with all investment decision, it is advisable to hunt steering from financial and tax professionals to navigate the complexities of Gold IRA transfers effectively. With cautious planning and execution, a Gold IRA can function a helpful part of a well-rounded retirement strategy.