In today’s financial landscape, private unsecured loans have turn into a viable choice for individuals seeking funds without the need for collateral. This is especially vital for these with bad credit, who could discover conventional lending avenues closed off. This report delves into the intricacies of personal loans for bad credit nys unsecured loans for individuals with poor credit histories, exploring the forms of loans accessible, their advantages and drawbacks, and the application process.

What Are Personal Unsecured Loans?

Private unsecured loans are loans that don't require any collateral, that means borrowers do not have to put up belongings like a house or automotive to safe the loan. Instead, lenders depend on the borrower’s creditworthiness and means to repay the loan. For individuals with dangerous credit, these loans generally is a double-edged sword—offering entry to funds while carrying increased interest rates and fewer favorable terms.

Who Qualifies for Personal Unsecured Loans?

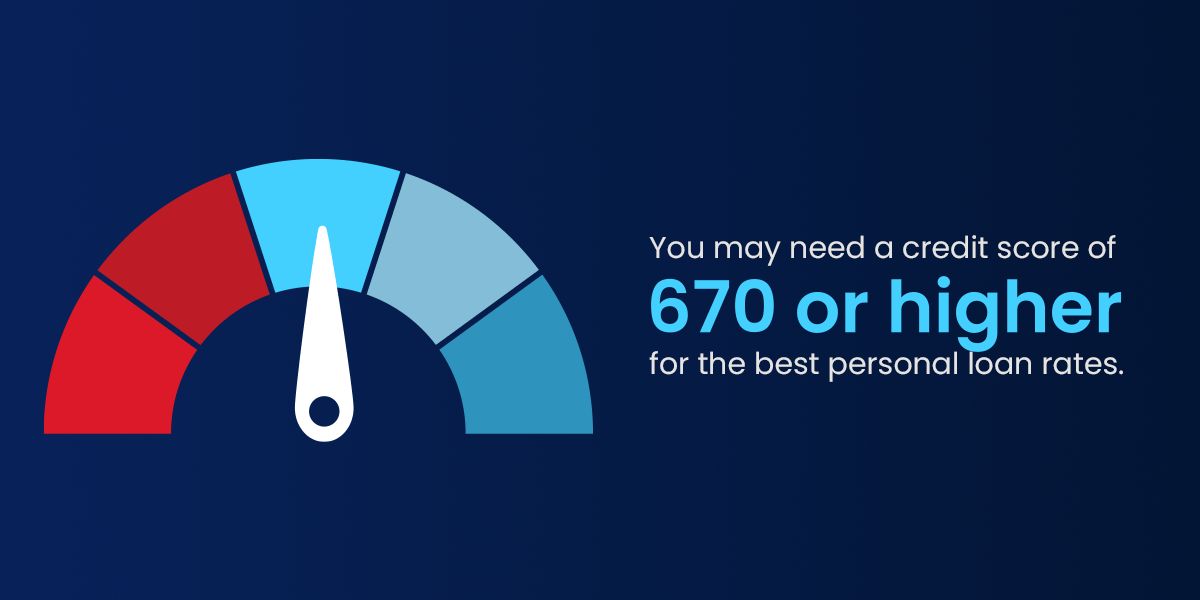

People with bad credit typically have a credit rating under 580. While this could make it extra challenging to secure a loan, many lenders specialize in providing loans to those with poor credit histories. These lenders could consider factors past simply credit scores, comparable to earnings, employment history, and existing debt levels.

Sorts of personal Unsecured Loans for Bad Credit

- Peer-to-Peer Lending: This model connects borrowers instantly with individual traders who are keen to fund loans. Peer-to-peer platforms typically have extra flexible lending standards than traditional banks.

- Credit score Unions: Many credit unions offer personal loans with lower curiosity charges and more lenient qualification necessities compared to banks. They often give attention to group members and should consider elements like personal loans for people with bad credit rating relationships and local residency.

- On-line Lenders: Quite a few on-line platforms cater particularly to borrowers with bad credit. These lenders usually present a fast software process and sooner funding occasions, though they could charge higher curiosity charges.

- Payday Loans: Whereas technically a form of unsecured loan, payday loans are often criticized for their exorbitant interest rates and predatory practices. Borrowers ought to exercise warning and consider this feature solely as a last resort.

- Title Loans: Though usually secured by a vehicle, some lenders may offer loans based on the worth of the borrower’s automobile without requiring a credit score check. However, this feature carries the chance of shedding the vehicle if the loan is just not repaid.

Advantages of non-public Unsecured Loans for Bad Credit

- Entry to Funds: Unsecured cash loans for bad credit direct lender provide access to mandatory funds for emergencies, debt consolidation, or giant purchases, even for those with poor credit score.

- No Collateral Required: Borrowers don't threat shedding useful belongings, making unsecured loans less dangerous in that regard.

- Versatile Use: Funds from personal loans can be used for a variety of functions, including medical expenses, home repairs, or training costs.

- Potential for Credit score Improvement: Successfully repaying a personal loan can help enhance a borrower’s credit score score over time, opening doorways to raised monetary alternatives sooner or later.

Drawbacks of private Unsecured Loans for Bad Credit

- Increased Curiosity Charges: Lenders perceive borrowers with unhealthy credit score as increased threat, leading to considerably higher interest charges in comparison with those offered to individuals with good credit score.

- Shorter Loan Terms: Many lenders offer shorter repayment periods, which can lead to higher monthly funds and financial pressure.

- Potential for Debt Cycle: Borrowers could find themselves in a cycle of debt in the event that they take out loans to pay off current debts with out addressing the underlying financial points.

- Charges and Penalties: Many lenders charge origination charges, late fee fees, and other charges that can add to the overall cost of the loan.

The applying Course of

- Assess Your Monetary Scenario: Earlier than making use of for a loan, borrowers ought to evaluate their financial well being, together with income, bills, and current debts. Understanding one’s monetary state of affairs might help determine how a lot to borrow and what monthly payments can be managed.

- Analysis Lenders: It’s important to buy around and compare completely different lenders, curiosity rates, phrases, and fees. Online reviews and ratings can present insights into the lender’s status.

- Examine Eligibility Requirements: Each lender has its own criteria for approving loans. Understanding these necessities might help borrowers establish which lenders to strategy.

- Gather Necessary Documentation: Most lenders will require proof of earnings, employment verification, and identification. Having these documents prepared can streamline the applying course of.

- Apply for the Loan: After selecting a lender, borrowers can full the applying course of, which could also be carried out on-line or in person. For those who have any inquiries regarding where by and how to make use of personal unsecured loans for people with bad credit, you can contact us from the webpage. Be ready for a credit score test, which may barely affect the credit score rating.

- Evaluation Loan Phrases: If approved, borrowers ought to carefully review the loan settlement, making certain they understand the interest charges, repayment terms, and any charges associated with the loan.

- Repayment: Once the loan is secured, it’s crucial to make well timed funds to keep away from penalties and potential damage to credit score scores.

Conclusion

Private unsecured loans provide a possible lifeline for individuals with unhealthy credit, offering access to funds when conventional options is probably not out there. Whereas they include their own set of challenges, understanding the varieties of loans obtainable, the appliance process, and the associated risks can empower borrowers to make knowledgeable choices. With cautious planning and accountable borrowing, individuals with bad credit score can navigate the world of non-public unsecured loans and work towards bettering their financial health. As at all times, it is advisable to seek the advice of with a financial advisor earlier than taking on new debt, guaranteeing that the chosen loan aligns with one’s lengthy-term financial goals.