Introduction:

Swing trading is a popular strategy among traders looking to capture short- to medium-term gains in financial markets. Success in swing trading relies on timing, data analysis, and effective risk management. Digital marketplaces, such as jokerstash, provide a unique lens to understand how fast, secure, and well-structured platforms can influence trading decisions. By borrowing principles from digital asset ecosystems, swing traders can enhance their strategies and optimize returns.

Core Principles of Swing Trading Inspired by Digital Platforms:

Market Analysis & Timing:

Just like efficient marketplaces track inventory and transactions in real-time, swing traders rely on technical indicators, price trends, and volume analysis to identify entry and exit points.Security & Risk Management:

Ensuring secure trading environments is critical. For swing traders, this translates into setting stop-loss levels, position sizing, and avoiding high-risk trades without proper research.Speed & Execution:

Successful platforms prioritize fast execution. Similarly, swing traders must act quickly on signals, as delays can lead to missed opportunities or reduced profits.Portfolio Diversification:

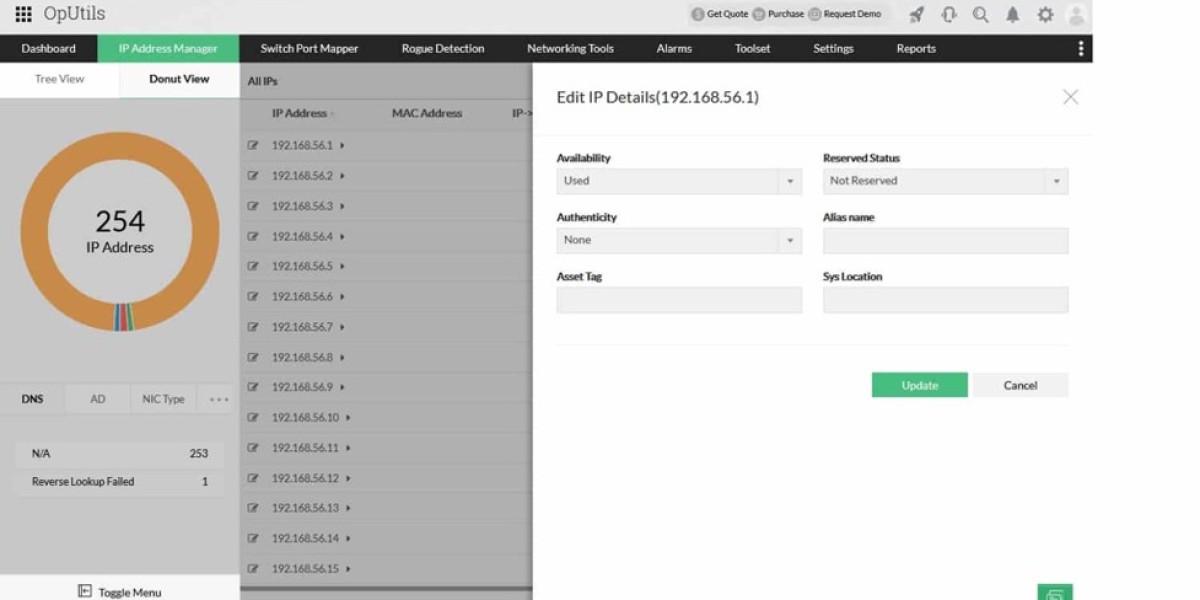

Diversifying across different assets, sectors, or cryptocurrencies can mitigate risk—mirroring how digital marketplaces handle multiple product categories for balanced growth.Data-Driven Decisions:

Digital platforms often use analytics to guide decisions. Swing traders benefit from charting tools, moving averages, RSI, and other indicators to make informed choices.

Swing Trading Strategies for Maximum Efficiency:

Trend Trading: Riding upward or downward price movements using moving averages or trendlines.

Breakout Trading: Capitalizing on price breaking through support or resistance levels.

Pullback Trading: Entering trades after temporary reversals in the direction of the main trend.

Momentum Trading: Following assets showing strong price momentum for quick gains.

Each strategy requires discipline, timely decision-making, and proper risk management—principles that digital marketplaces exemplify through structure and efficiency.

Conclusion:

Swing trading is both an art and a science. By applying insights from digital marketplaces like JokerStash—speed, security, diversified access, and analytics—traders can sharpen their swing trading approach, minimize risk, and maximize short- to medium-term profits. In today’s fast-paced financial environment, learning from well-structured systems can make the difference between a successful swing trade and a missed opportunity.