Whether you're a neighborhood café, a home-based designer, or a production unit, having that 15-digit GST number can open a globe of opportunities. If you run a local business in India, opportunities are you have actually already heard the term GST being sprayed in discussions with accounting professionals, vendors, and perhaps even clients. Some company owner get anxious about it, thinking of hills of documentation and endless federal government kinds. Others see it as a ticket to development, due to the fact that GST (Product and Services Tax obligation) can make you look much more qualified and open doors to larger customers. Each state collected Worth Included Tax (BARREL) for the sale of goods within the same state.

Under the GST legislation, a regular taxpayer will certainly be needed to furnish three returns regular monthly and one annual return. In a similar way, there are separate returns for a taxpayer signed up under the make-up system and a taxpayer signed up as an Input Service Representative. Goods and Provider Tax(GST) is an extensive tax levied on manufacture, profession and solutions across India. From 1st July, 2017 GST has replaced the majority of Centre and State enforced indirect taxes like barrel, Service Tax obligation, Excise etc.

If you liked this information and you would certainly like to receive additional details relating to https://auraweiner.com/ kindly visit the web site. In instance you're an individual who requires to submit taxes, then it's suggested to sign up with hands with a Revenue Tax Planning, Audit, and Guarantee Business or person to make an informed decision. In this circumstance, you can't trust the AI economic advisor as it supplies output based upon the training module and information on which the modern technology has actually been trained. To get real-time upgraded details, effective tax saving methods, and legal means to cut taxes to the degree, of working with a person for your bookkeeping support is the perfect option. CAs, specialists and organizations can get GST prepared with Clear GST software program & & certification training course. Our GST Software helps CAs, tax obligation specialists & & company to manage returns & & billings in an easy manner. Our Goods & & Provider Tax obligation course includes tutorial videos, guides and expert assistance to aid you in understanding Product and Provider Tax.

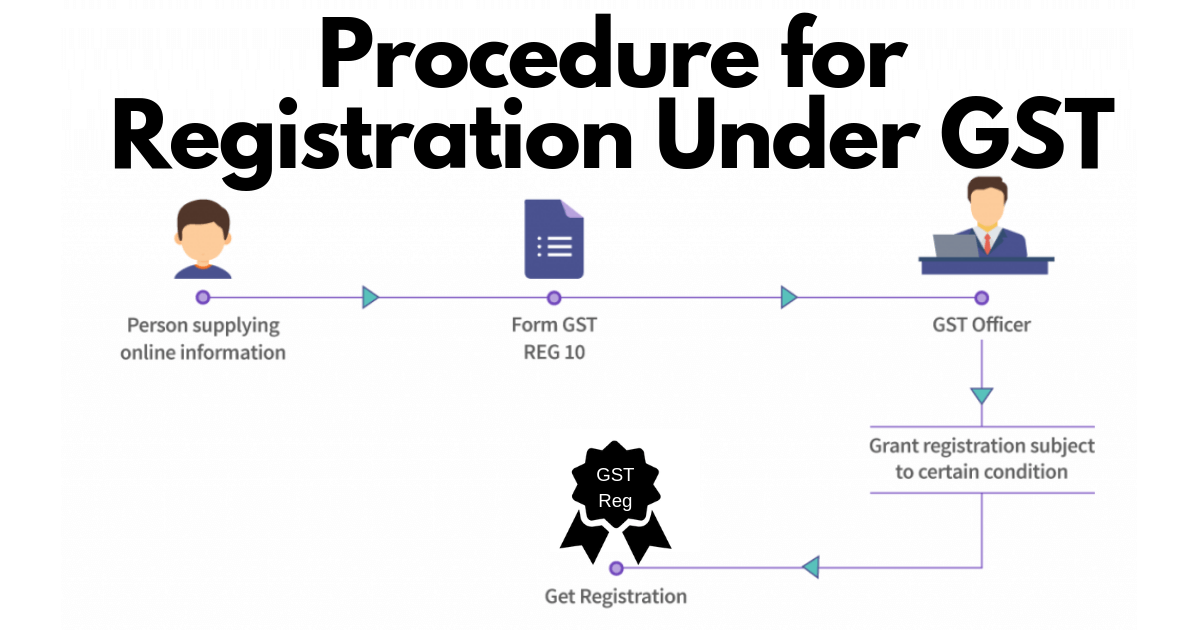

The certification of GST enrollment is issued by the GSTIN and GST Number will be allocated in approx a week time. GST paid by individuals goes to the main and state federal governments and serves as an important source of income to run the country. It integrates with GST portal and e-way bill website and decreases data entrance mistakes and interoperability of invoices.

We are not a law office and do not offer legal solutions ourselves. Services exceeding turnover limits (20 lakh, or 10 lakh in special states), participated in interstate supply, or running on shopping systems. Save tax obligations with Clear by purchasing tax conserving mutual funds (ELSS) online.

The GST enrollment solutions at Clear assists you to obtain your business GST registered and get your GSTIN. Experts at Clear will assist you with our GST enrollment solutions for the applicability and conformities under GST for your service and obtain your service signed up under GST.

It is an extensive indirect tax imposed on the supply of goods and solutions across India. Introduced on July 1, 2017, GST replaced numerous indirect taxes like import tax obligation, BARREL, and service tax obligation with a solitary, unified tax obligation structure. CA Vishal Madan and his team supply superior GST registration solutions which streamlines tax conformity for companies and permitting them to concentrate on their major procedures.

Also if you require any Tax obligation Appointment & & Support on any Tax obligation policies & & laws, Our Virtual Accounts Supervisor will aid you to figure out your Tax associated problems. We do your MSME Registration in the brand-new Udayam Enrollment Portal which was launched on 1st July 2020. Existing customers of MSME can approach us for re-registration in this new portal. The Old MSME (Udhyog Aadhar Number) will be valid just till 31st March 2021. Both Kind 16 and 16A have been made use of to get the information of revenue and (Tax obligation Deducted at Source) TDS to file earnings tax. To proof this activity, the employer will give you the Kind 16.

Our specialists suggest the very best funds and you can obtain high returns by investing straight or via SIP. Download And Install Black by ClearTax App to file returns from your mobile phone. To understand even more concerning the GST registration process & & costs or get a customised quote for your business, call us today at or go here to fill our quick query form. Highly suggested for every taxpayer in India who desires accurate returns and assurance. Our devoted team of GST professionals is below to guide you via every step of the GST procedure.

The certificate of GST enrollment is provided by the GSTIN and GST Number will be allocated in approx a week time. The GST enrollment services at Clear assists you to obtain your service GST registered and acquire your GSTIN. Professionals at Clear will certainly assist you with our GST enrollment solutions for the applicability and compliances under GST for your organization and obtain your business signed up under GST. TaxBuddy can supply advice on declaring GST returns even if there's no repayment included, making certain that storekeepers fulfill their GST commitments properly. Presented on July 1, 2017, GST changed multiple indirect tax obligations like import tax responsibility, BARREL, and service tax obligation with a single, unified tax obligation structure.