In an more and more unsure economic landscape, many investors are wanting for ways to secure their retirement savings. One well-liked choice that has gained traction in recent years is the Gold Individual Retirement Account (IRA). This funding vehicle allows people to carry bodily gold and other treasured metals within their retirement accounts, providing a hedge in opposition to inflation and market volatility. In this text, we'll discover the benefits and concerns of investing in a Gold IRA.

Understanding Gold IRAs

A Gold IRA is a sort of self-directed individual retirement account that permits investors to incorporate bodily gold, in addition to different authorised treasured metals, as a part of their retirement portfolio. Not like conventional IRAs that typically hold stocks, bonds, and mutual funds, Gold IRAs provide a singular opportunity to spend money on tangible assets. The interior Income Service (IRS) has particular laws relating to which types of gold and precious metals are eligible for inclusion in a top 10 gold ira companies ira investing best gold ira companies, together with bullion coins and bars that meet sure purity standards.

Benefits of Gold IRA Investment

1. Hedge In opposition to Inflation

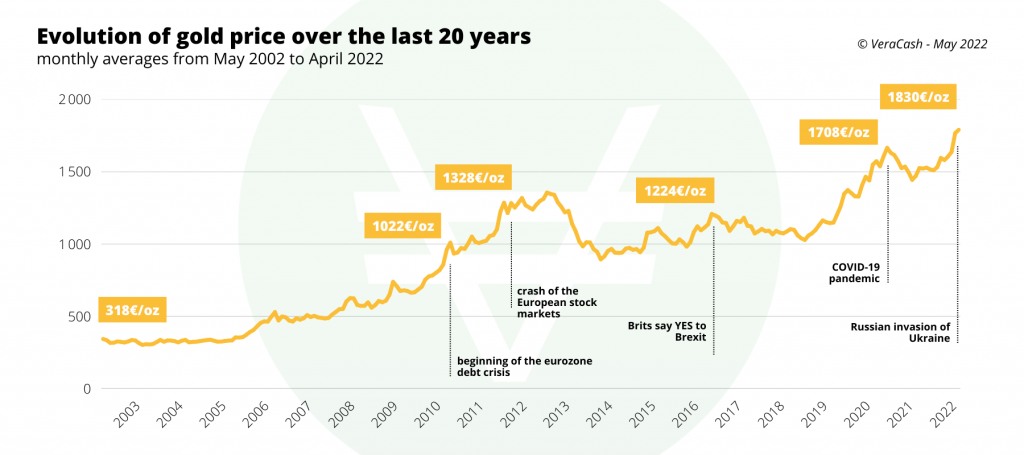

Considered one of the first causes traders flip to gold is its historical role as a hedge against inflation. Throughout instances of financial instability, the value of forex can decline, leading to the erosion of buying power. Gold, on the other hand, has maintained its worth over the centuries and often appreciates when inflation rises. By including 5 best gold ira companies in their retirement portfolio, buyers can protect their savings from the antagonistic results of inflation.

2. Diversification

Diversifying an funding portfolio is a basic strategy for managing threat. Gold IRAs present a chance to diversify past traditional asset classes. By including gold ira companies review [https://www.instapaper.com] to a portfolio, traders can reduce their general threat exposure. Gold typically behaves otherwise than stocks and bonds, which means it may possibly provide stability during market downturns. This diversification can be notably useful for retirees who need to preserve their wealth and reduce threat.

3. Secure Haven Asset

Gold is commonly thought-about a "protected haven" asset, that means that during times of geopolitical uncertainty or financial crisis, buyers flock to gold as a retailer of value. This characteristic could make gold a pretty option for those involved in regards to the potential for economic downturns. By holding gold in a retirement account, buyers can have peace of thoughts understanding that they have a tangible asset that will retain value when other investments falter.

4. Tax Benefits

Like conventional IRAs, Gold IRAs provide important tax benefits. Contributions to a Gold IRA could also be tax-deductible, relying on the person's revenue and tax filing status. Additionally, any beneficial properties realized from the sale of gold throughout the IRA are tax-deferred until withdrawal, allowing the investment to grow without the rapid tax burden. This can be significantly advantageous for long-term investors looking to maximise their retirement savings.

Considerations When Investing in Gold IRAs

While Gold IRAs provide a number of advantages, there are also necessary issues to bear in mind before investing.

1. Fees and Costs

Investing in a Gold IRA usually includes various charges, together with setup fees, storage charges, and transaction fees. It is essential for investors to grasp these costs upfront, as they will impression the overall return on investment. Moreover, some custodians might cost higher fees for dealing with valuable metals compared to conventional assets. Carefully evaluating fees among totally different custodians will help investors make knowledgeable decisions.

2. Restricted Liquidity

Gold is a bodily asset, and whereas it may be sold, it may not all the time be as liquid as conventional investments like stocks or bonds. Traders should consider the effort and time required to sell gold, especially if they should access funds rapidly. Additionally, the price of gold can fluctuate based mostly on market conditions, meaning that traders might not always obtain the expected return when selling their gold holdings.

3. Regulatory Compliance

Gold IRAs are topic to specific IRS rules, and it is essential for traders to work with custodians who are knowledgeable about these guidelines. Failure to comply with IRS rules may end up in penalties and taxes. Traders should be sure that their chosen custodian is reputable and skilled in handling Gold IRAs to avoid potential pitfalls.

4. Market Volatility

While gold is commonly seen as a stable funding, it isn't immune to market volatility. The value of gold can fluctuate based on varied components, together with economic indicators, geopolitical events, and changes in interest charges. Investors must be prepared for the potential of price fluctuations and have a protracted-time period perspective when investing in gold.

Conclusion

Investing in a Gold IRA could be a strategic move for those seeking to diversify their retirement portfolios and protect their savings from inflation and economic uncertainty. With the potential advantages of a hedge against inflation, portfolio diversification, and tax benefits, a Gold IRA could be an appealing option for many investors. Nevertheless, it is essential to think about the related costs, liquidity, regulatory compliance, and market volatility before making any investment decisions.

As with every funding, people should conduct thorough research and seek the advice of with financial advisors to find out if a Gold ira investing best gold ira companies aligns with their total retirement strategy. By rigorously weighing the benefits and considerations, buyers can make knowledgeable choices that help safe their monetary future.